In an era where financial literacy and technological advancement converge, trading simulators have emerged as powerful tools for both novice and seasoned investors. They offer a low-risk environment to practice strategies, analyze market trends, and gain valuable experience.

However, as their accessibility and popularity surge, a pressing question arises: are these simulators too easy? Do they accurately mirror the complexities and unpredictabilities of real-world trading?

This deep dive seeks to unravel the intricacies of trading simulators, exploring their potential pitfalls and advantages, while examining how they shape our understanding of the markets. By scrutinizing the mechanics behind these platforms, we aim to discern whether their educational value stands up against the stark realities of trading outside the digital realm.

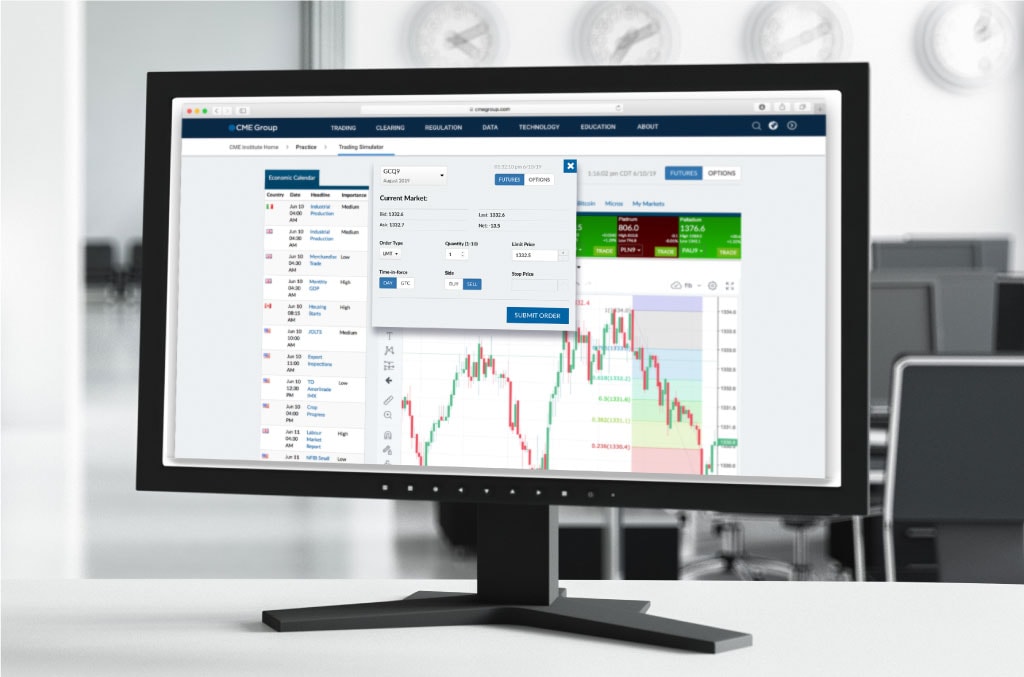

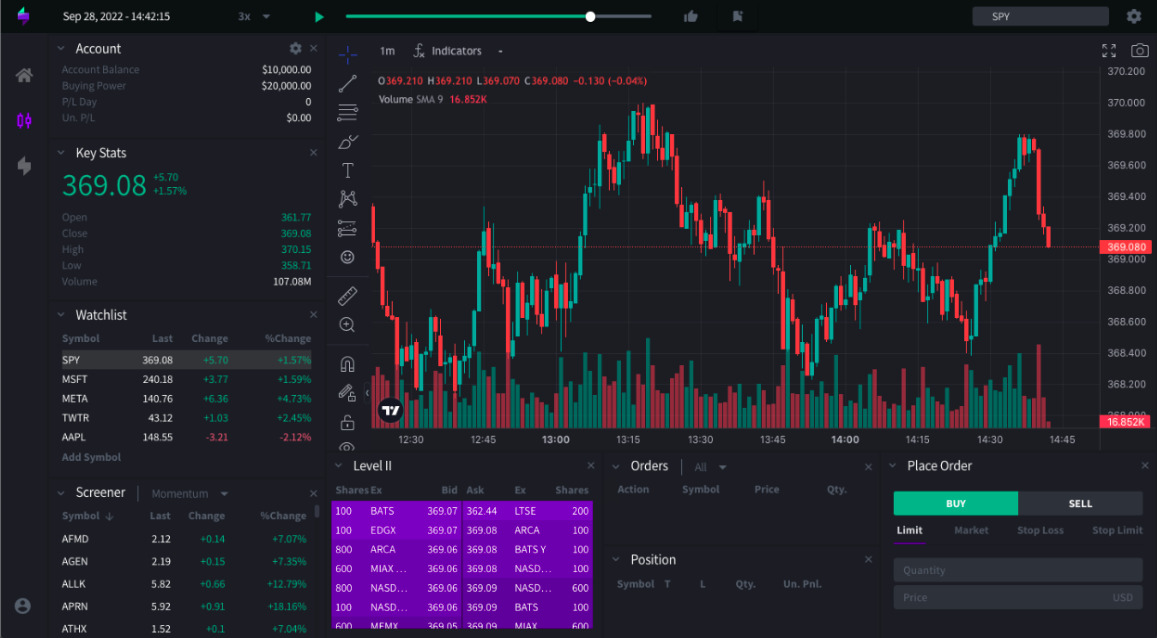

Types of Trading Simulators

Analyzing the Accuracy of Trading Simulators

Analyzing the accuracy of trading simulators reveals a landscape marked by both impressive innovation and glaring discrepancies. On one hand, these simulators are designed to mimic real market conditions, allowing users to practice trading without financial risk.

They utilize historical data, attempt to replicate trading fees, and simulate various market scenarios to provide a seemingly authentic experience. However, a closer examination uncovers significant limitations; for instance, market psychology, emotional decision-making, and the impacts of sudden market shifts often elude these platforms. As a result, while they serve as useful educational tools, their reliability in forecasting real-world trading outcomes comes into question.

Many traders find themselves grappling with a dissonance: what works flawlessly in the simulator doesn’t always translate to the chaos of live markets, where the stakes are profoundly higher. Thus, users must tread carefully, recognizing that a false sense of security can emerge from these polished yet imperfect simulations.

The Benefits of Using Trading Simulators

Trading simulators offer a unique playground for both novice and seasoned traders, providing a risk-free environment to hone one’s skills and strategies. Imagine being able to execute trades without the anxiety of financial loss; this freedom allows for experimentation with different approaches, from aggressive day trading to more conservative, long-term strategies.

Moreover, simulators often mimic real market conditions, offering insights into order types, market volatility, and the importance of timing, all while enabling traders to analyze their performance with detailed metrics. This iterative process of trial and error fosters a deeper understanding of market dynamics, bridging the gap between theoretical knowledge and practical application.

Ultimately, these tools can be instrumental in building confidence and instilling a disciplined trading mindset, setting the stage for future success in actual trading scenarios.

Conclusion

In conclusion, while trading simulators offer invaluable tools for traders looking to hone their skills and test strategies without risking real capital, the question of their accuracy and realism remains a pertinent topic. The convenience of features such as bar replay free functionality enhances the learning experience by allowing users to revisit historical trading scenarios, yet it may also create an illusion of ease that can misrepresent the complexities of live trading.

Ultimately, while these simulators can serve as powerful educational resources, traders must remain vigilant about the limitations they present and supplement their practice with real-world experiences to truly prepare for the challenges of the market. Balancing the benefits of simulation with the unpredictability of actual trading situations is key to developing a well-rounded skill set.